Statements Open Menu

Contents of your company’s checking account statements

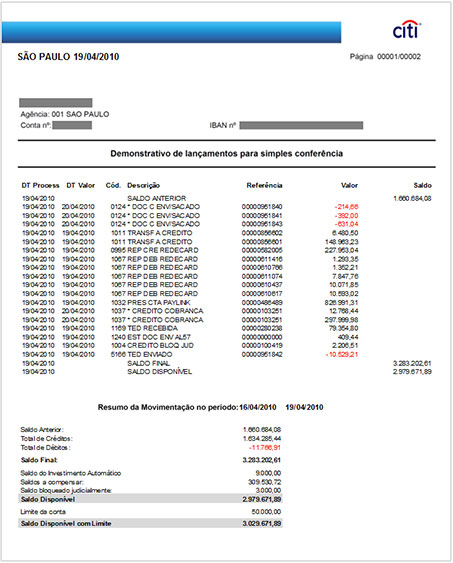

The new information on the statements will make it easier to follow daily transactions in your account.

New information:

- Value date and book date;

- Judicially frozen assets balance;

- Automated investment balance.

TapPlace the mouse arrow over the highlighted buttons on the statement below to see the information.

*Statement not available in english.

1 Processing Date: Accounting transaction date (date when it was entered in the system). 2 Amount Date: Date for which the amount of the transaction will be made available in the account (e.g. in the case of a DOC (wire transfer) received, this date is the business day following the Processing Date). 3 Previous Balance: Opening accounting balance of the day.Total Credits: Total amount of credits incurred in the period of the statement, including transactions of funds cleared by court.

Total Debits: Total amount of debits incurred in the period of the statement, including court-ordered freezes transactions.

Closing (or Accounting) Balance: Closing/accounting balance of the day. It is comprised of the Previous Balance plus all credits and debits, except for court-ordered freezes and releases, occurred in the period. 4 Automatic Investment Balance: Balance of ACF (Applied Cash Flow) product.

Balance to clear: Balance of transaction occurred, but whose value is still unavailable to transact (e.g.: check deposit, DOCs to credit, collection claims, debits by payment of bank-issued invoices, etc).

Court-ordered frozen balance: Total amount of the account in question that is frozen by court order (this balance does not take into account funds frozen in other accounts or products).

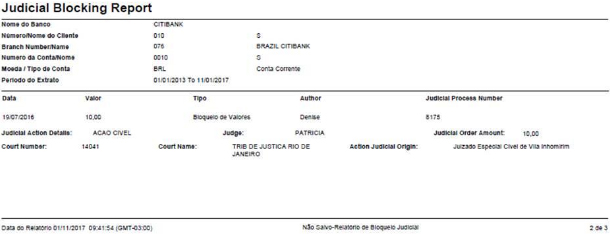

See the new court-ordered freezing report.

Available balance: Total amount available including that applied in automatic investment (ACF). 5 Account limit: Limit engaged for the account.

Available balance with Limit: Total amount available for transaction considering the limit.

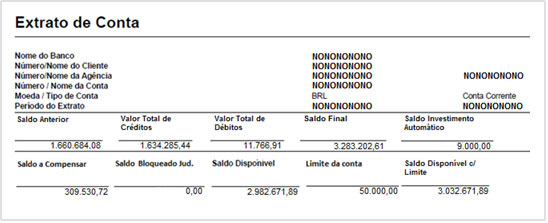

CitiDirect Statement

See the reorganized balances in the statement generated by CitiDirect.

*Statement not available in english yet.

1 Previous Balance: Opening accounting balance of the day.Balance to clear: Balance of transaction occurred, but whose value is still unavailable to transact (e.g.: check deposit, DOCs to credit, collection claims, debits by payment of bank-issued invoices, etc). 2 Total de Credits: Total amount of credits incurred in the period of the statement, including transactions of funds cleared by court.

Court-ordered frozen balance: Total amount of the account in question that is frozen by court order (this balance does not take into account funds frozen in other accounts or products).

See the new court-ordered freezing report. 3 Total Debits: Total amount of debits incurred in the period of the statement, including court-ordered freezes transactions.

Available balance: Total amount available including that applied in automatic investment (ACF). 4 Closing (or Accounting) Balance: Closing/accounting balance of the day. It is comprised of the Previous Balance plus all credits and debits, except for court-ordered freezes and releases, occurred in the period.

Account limit: Limit engaged for the account. 5 Automatic Investment Balance: Balance of ACF (Applied Cash Flow) product.

Available balance with Limit: Total amount available for transaction considering the limit..