Frequently Asked Questions (FAQ) Open Menu

Answers to frequently asked questions

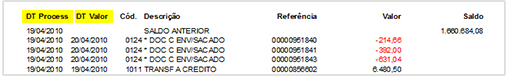

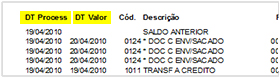

With the presentation of Book Date and Value Date it becomes easier to identify retroactive and future transactions. The Book Date is the date by when the transaction was booked into the account, while the Value Date is the date by when the amount is effective.

*Statement not available in english.

- No changes to statements or electronic files sent or pulled – all retroactive or future transactions will appear on the statement on the date they were booked, comprising the balance of that day only; Once generated, the statements will suffer no further changes, even when there are retroactive entries.

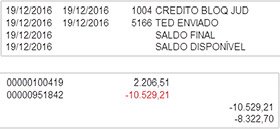

Amounts frozen by court order will be kept in your account, incorporated into the Closing Ledger Balance. Therefore, you will know that they are there, unavailable to transact though (they will not be part of the Available Balance).

*Statement not available in english.

On the migration day to Citi’s new global business technology platform, an internal procedure will be made to start considering the judicially frozen amounts into the account's Closing Ledger Balance, as follows:

Step 1:

One credit transaction of the total judicially blocked amount will be booked.

Step 2:

Individual freezing debit transactions for each judicial block order will be booked making up the credit transaction booked in Step 1.

For example:

If on the migration day an account holds R$10,000.00 frozen due to four still active court orders with the hypothetical value of R$2,500.00 each, you will see a credit (properly identified as “JUDICIALLY ASSETS UNFREEZING” and as reference “BACENJUD BALANCE HISTORY”) in this account with the amount of R$10,000.00 and also four additional debits with the amount of R$2,500.00 each (identified as “JUDICIALLY ASSETS FREEZING”).

- This procedure will change absolutely nothing in the accounts available balance nor it will affect any other clearance pending transaction.

A new report will be available to check upon the details of all court orders that make up the judicially blocked balance. So, you will be able to follow the orders more conveniently by getting it yourself from CitiDirect anytime.

- There will be no layout changes in any file format.

- Reconciliation electronic files which formats already use two date fields (book date and value date) will have them filled just like they are presented on the statements.

- The “Available Balance” and “Closing/Accounting Balance” fields shall be filled following the same concept used on the new statements.

- Remember that the Closing/Accounting Balance will have some changes in the way they are currently presented:

- It will contain all transactions performed on that day, regardless if they haven't been cleared yet or if they are retroactive.

- All judicially blocked amounts are already contained in it. Hence, transactions for freezing or unfreezing occurred during this period will not change it (as per the answer to the question “What will happen to the judicial blocked balance on Citi’s system migration day?” in this FAQ).

- For customers with contracted Automated Investment, the Available Balance will be summed with the invested amount.

Aiming at a standardized process and also revalidation of electronic addresses, the automatic account statements delivery may be interrupted. If you no longer receive the e-mails, you should contact us by phone and request Citi’s representative to enable the delivery.